Table Of Content

The total amount sellers pay in closing costs can be negotiated with the buyer before an offer is accepted and during the inspection and appraisal processes. After including real estate commissions, sellers often pay 8–10% of the sale price. You calculate your net proceeds by subtracting the costs of selling your home and your remaining mortgage balance from the sale price. For example, if your sale price is $1,000,000, your remaining mortgage balance is $350,000, and the total closing costs are $60,000, then your net proceeds would be $590,000. Net proceeds in real estate are the amount of money a seller receives after their closing costs and mortgage balance have been deducted from the sale price.

Net proceeds and taxes

The net proceeds are almost always sent from the escrow company to the seller on the day, or day after, the home is sold. When listing a home on the market, the amount of money you’ll ultimately pocket from the sale is often top of mind. The money a home seller keeps after all fees, commissions, closing costs and other expenses have been paid is referred to as net proceeds. Your home doesn't need to be in tip-top condition, but buyers do want a home without an extended list of needed repairs and improvements. You can seek advice from your real estate agent to determine which ones are worth making.

Idaho Mortgage Calculator - The Motley Fool

Idaho Mortgage Calculator.

Posted: Thu, 07 Mar 2024 08:00:00 GMT [source]

How to make more money when you sell your house

Alternatively, you might sell your home before buying a new one, in which case you’ll have to pay for temporary lodging (monthly rent or a hotel) and possibly storage. The seller’s closing statement is your chance to make sure there aren’t any thousand-dollar charges listed where they shouldn’t be. The result of all this research is a tool that navigates the quirks of home sales transactions to give you information that is tailored for you. If you’ve calculated your proceeds and still have questions, contact a Redfin agent in your area. Home Guide states that painters charge between $1 to $3 per square foot to paint a room. The average cost of painting a room ranges from $350 to $850.

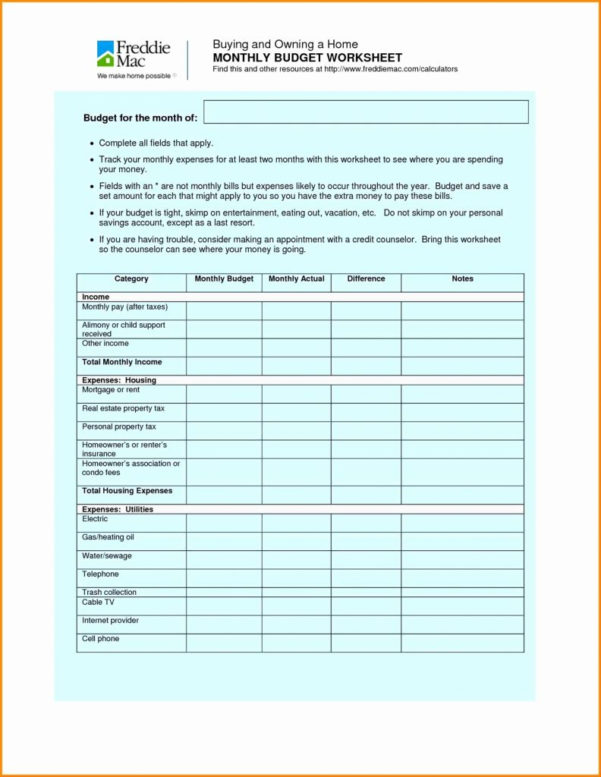

How to calculate net proceeds

Three days prior to closing, the seller receives a closing disclosure where the seller can see all the details about the deal including expenses. The commission to the real estate agent is 4%, transfer tax fee of 1%, payment of remaining mortgage of $60,000, and payment towards repairs of $1,000. Our seller closing cost calculator provides the total amount that you will receive from selling your home once all closing and miscellaneous costs have been deducted. Our calculator uses the estimated home selling price, and various costs such as the real estate agent commission, closing expenses, remaining mortgage balance, and seller discounts. The profits you make from selling your home are called net proceeds. Your net proceeds are determined by your home’s sale price minus expenses, such as home improvements, staging costs, agent fees and paying off your remaining mortgage.

Type of home loans to consider

A pre-listing inspection will likely cost around $350, according to HomeAdvisor, and it will fill you in on any major problems before a potential buyer sees them. For example, if a home inspector finds a leak in your bathroom, you can proactively address the problem and remove any possibility of a buyer asking you to lower the price to repair it. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. Estimate the cost of selling your home and the net proceeds you could earn from the sale. There are a number of expenses to consider when selling your home.

How much equity will I have when I sell my house?

Our home sale calculator takes these costs into account when calculating your net proceeds, so you can estimate how much you’re likely to make on your house. The money you make from a home sale is not considered income, though it might be subject to a capital gains tax. That's the difference between what you paid for your property and what you sold it for.

How much does it cost to sell a home?

Seller concessions (sometimes called assists or contributions) are buyer closing costs that sellers agree to pay. For example, a seller may agree to pay for home appraisals, inspections, property taxes, loan origination fees, title insurance, or attorneyfees. Concessions aren't required, though sellers usually offer them as an incentive to attract more buyers. A net sheet is a document that shows a seller their estimated proceeds from the sale of their home. It includes the estimated sale price, all closing costs, and the seller's estimated mortgage balance.

If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. Use Zillow’s home loan calculator to quickly estimate your total mortgage payment including principal and interest, plus estimates for PMI, property taxes, home insurance and HOA fees.

What costs can vary the greatest from state to state for sellers?

The difference in the closing costs between the buyer and the seller is due to the fact that they pay for different items that apply to their situation. Depending on the state, some items may need to be paid for by the buyer while others may be paid for by the seller. If you’re thinking about selling your house, you’re likely thinking about all the money you will make from the sale. However, you don’t get to keep all the cash when you sell your most valuable asset — some of it goes toward a variety of expenses, including taxes and closing costs. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI).

Canada Closing Costs Calculator - NerdWallet

Canada Closing Costs Calculator.

Posted: Fri, 09 Jun 2023 23:13:03 GMT [source]

VA loans are partially backed by the Department of Veterans Affairs, allowing eligible veterans to purchase homes with zero down payment (in most cases) at competitive rates. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home.

If you find them, which is likely, have those areas repaired before selling your house. Around 23 percent of buyers also don’t mind overlooking property issues. Moreover, around 10 percent of buyers thought of anything negative about a staged home.

You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required. There are different sets of fees included in the seller’s closing costs. Closing costs for the seller can end up costing tens of thousands of dollars, but there are certain items that can be negotiated down in price. It may also be the case that some items are overpriced or are not required so the seller has the ability to negotiate those as well. It is important to understand what is included in the closing costs to know what exactly you are paying for each service. The following list provides the breakdown of closing costs into distinct categories.

The costs for full staging can range from about a thousand to several thousand dollars. Some staging companies will require an upfront payment, while others will allow you to make payment through the proceeds of your home sale. The expenses you pay to sell your home help ensure that all the right steps are taken so that you don’t wind up with any surprises.

If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment. This is a monthly cost that increases your mortgage payment. To calculate how much equity you’ll have when you sell your home, subtract how much you owe on your mortgage from your home’s market value. Then factor in closing costs (usually 7.59–8.59% of your home’s value). Whatever's left over will be your estimated profits from the home sale.

No comments:

Post a Comment